The list that follows is our attempt to create a comprehensive list of shingles that appear to qualify for the maximum 1500 2010 energy tax credit.

Residential energy credits qualified roofing.

To receive tax credit the homeowner must complete and submit irs form 5695.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

25d is the residential energy efficient property credit.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

And 300 for any item of energy efficient building property.

This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

This is known as the residential renewable energy tax credit.

25d residential energy credit sec.

Homeowners who have not submitted for the tax credit for any energy efficient home improvement new windows doors insulation or energy star qualified roof may qualify.

Solar wind geothermal and fuel cell technology are all eligible.

The homeowner s primary residence may be eligible for the tax credit.

2 when filing your taxes for tax years 2019 2020 and 2021 take note of the adjustments that happen year to year.

Of that combined 500 limit a maximum of 200 can be for windows.

150 for any qualified natural gas propane or oil furnace or hot water boiler.

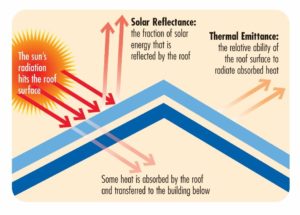

Certified roof products reflect more of the sun s rays which can lower roof surface temperature by up to 100f decreasing the amount of heat transferred into your home.

Federal income tax credits and other incentives for energy efficiency.

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products.

We generated this list by looking at energystar qualified shingles whose manufacturers provide a manufacturers certification statement claiming that their shingles qualify.

An individual is allowed as a credit against the tax imposed for the taxable year an amount equal to the sum of the qualified solar electric property expenditures.

A credit limit for residential energy property costs for 2018 of 50 for any advanced main air circulating fan.