Required minimum distribution rmd is the irs mandated minimum annual withdrawal amount from tax deferred retirement accounts for participants aged 70 or 72 depending on the year they were born.

Required minimum distribution annuity tables.

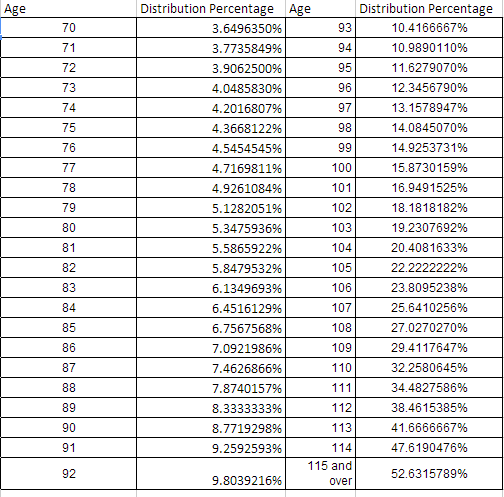

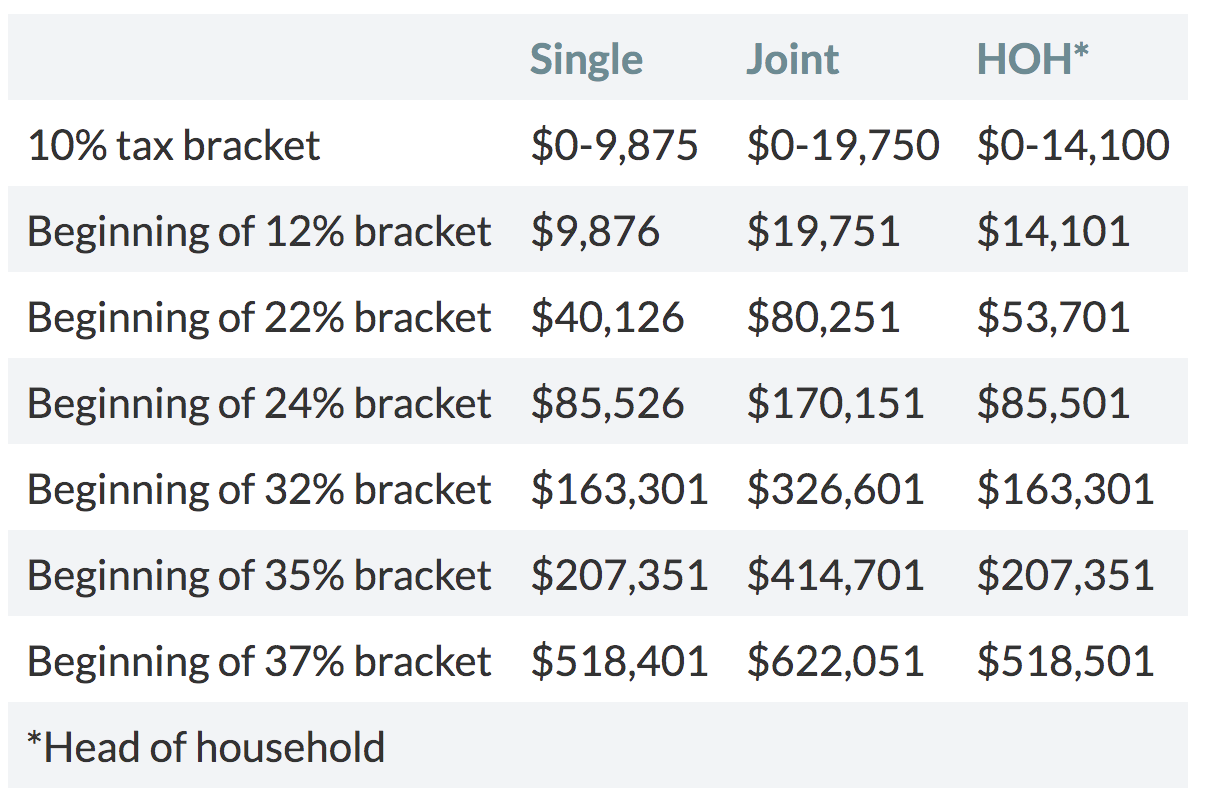

Ira required minimum distribution rmd table for 2020.

Required minimum distribution rmd the irs requires that you withdraw a minimum amount known as a required minimum distribution from iras 401 k s and other types of retirement accounts annually starting at a certain age.

Repeat steps 1 through 3 for each of your iras.

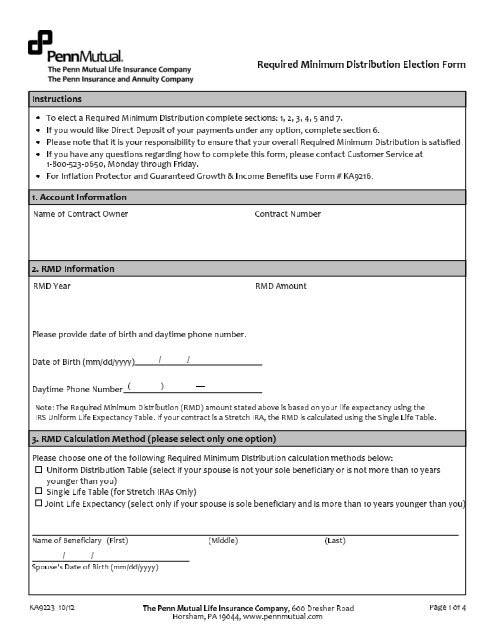

Annuities held inside an ira or 401 k are subject to rmds.

Table iii uniform lifetime age distribution period age distribution period age distribution period age distribution period 70 17 127 4 82 94 9 1 106 4 2 71 16 326 5 83.

The table shown below is the uniform lifetime table the most commonly used of three life expectancy charts that help retirement account holders figure mandatory distributions.

This is your required minimum distribution for this year from this ira.

At age 72 qualified account owners are required to begin taking rmds from their iras.

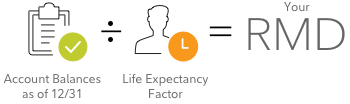

Determining how much you are required to withdraw is an important issue in retirement planning.

Faqs on required minimum distributions.

Chart of required minimum distribution options for inherited iras beneficiaries publication 590 b distributions from individual retirement arrangements iras publication 560 retirement plans for small business sep simple and qualified plans rmd comparison chart iras vs.

The other tables.

If you have a traditional ira a 401 k.

For all subsequent years you must take the money out of your accounts by dec.

Here is the rmd table for 2020 based on information from the irs.

A required minimum distribution is an amount that the tax laws require you to take out of certain types of retirement accounts once you reach a certain age.

Line 1 divided by number entered on line 2.